Leverage Fannie Mae’s Elimination of the Credit Score Requirement in Your Marketing

Beginning November 16, 2025, Fannie Mae will remove the long-standing minimum credit score requirement from its Desktop Underwriter (DU) automated system. Instead of enforcing a fixed score such as 620, DU will evaluate applicants using a broader set of risk factors such as payment history, income stability, debt load, and overall credit behavior.

In plain terms: It is no longer just about the number.

Why this is a big deal

For years, credit score minimums have created a hard barrier for otherwise capable borrowers, especially those with limited credit histories, thin files, or short-term setbacks. With this change, many potential buyers could gain access to homeownership opportunities they previously could not reach.

For real estate professionals, that means:

- A larger and more diverse buyer pool in markets where affordability has been tight.

- A potential boost in seller confidence, knowing more buyers may qualify.

- New opportunities to educate and guide clients who assumed they were locked out of the market.

Important note: Approval is not guaranteed. Borrowers still need to demonstrate creditworthiness. The focus is shifting toward a more holistic view of financial health, not a single score.

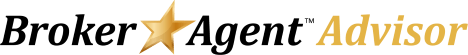

What agents should be communicating

Set expectations early and partner closely with lenders.

The takeaway

This is one of the most consequential mortgage updates in years. It signals a shift away from rigid score thresholds and toward real-world financial assessment. For agents, lenders, and referral partners in the Broker★Agent Advisor network, now is the time to get ahead of the conversation. Educate your audience, align with lending pros, and be the one who says: “It is not about lowering standards, it is about opening doors.”

How to leverage in your marketing

Use this development to engage your network, attract new clients, and reinforce your role as a trusted professional.

- Newsletter or social post: Announce the change and explain what it means for buyers and sellers. Invite questions using the caption below.

- Team or brokerage meeting: Discuss how this may affect qualification strategies and timelines. Strengthen lender relationships.

- Referral partner outreach: Co-brand a simple explainer with your preferred lenders. Position yourself as the go-to local translator of policy into opportunity.

- Training module idea: Review how this may impact closing cycles and buyer qualification, especially for thin-file or self-employed clients.

- Local lead generation: Use the social image below with a lead form inviting “Pre-qualification under the new DU rules.”

- Past lead reactivation: Reach out to buyers previously told their credit score was too low and invite them to re-check under the new guidelines.

👉 Click here for an editable template of the image below through Canva. Feel free to change colors, font, text, etc. to suit your needs. Referral Partner Logo usage restricted to certified Broker★Agent Advisor partners. Click here to qualify.

🏠 Fannie Mae no longer requires a minimum credit score to qualify for a home purchase.

Starting November 16, 2025, lenders will look beyond a single number to overall financial health, including payment history, income stability, and debt patterns.

✅ More qualified buyers may finally get the green light.

✅ Sellers could see renewed demand and confidence.

✅ If you were told your score was too low, let’s re-check your options.It’s not about lowering standards; it’s about opening doors.

Comment below for more information or tag a buyer who needs to hear this.

Recommended sizes: 1080×1080 (Instagram/Facebook), 1200×630 (LinkedIn/Facebook landscape), 1080×1920 (Stories)

Share this post

Prepared by Chad Golladay

Executive Publisher at Broker★Agent Advisor... Advice, Recognition, and Referral since 1996